Behavioral Health Market to Reach USD 172.61 Billion by 2034 North America Leads 2024, Asia-Pacific Fastest Growing

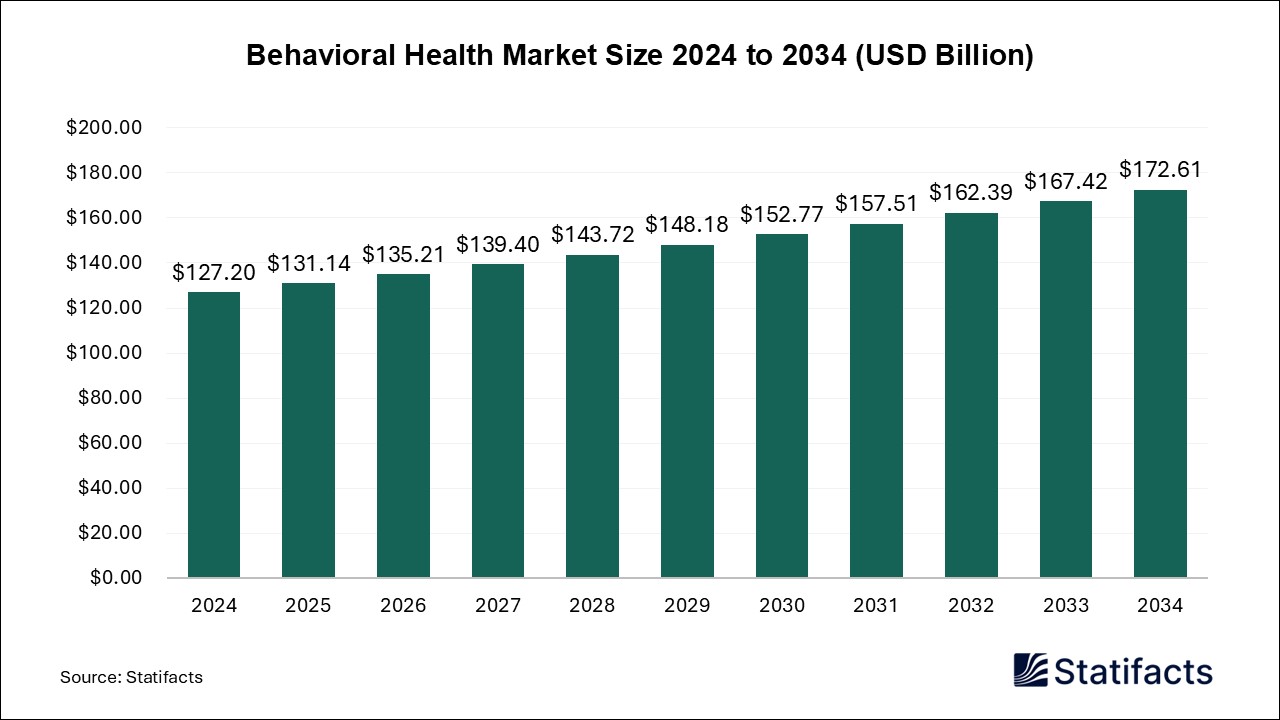

The global behavioral health market size is predicted to increase from USD 127.20 billion in 2025 and is anticipated to be worth around USD 172.61 billion by 2034, expanding at a CAGR of 3.1% from 2025 to 2034. A study published by Statifacts a sister firm of Precedence Research.

Ottawa, Sept. 23, 2025 (GLOBE NEWSWIRE) -- According to Statifacts, the global behavioral health market is forecasted to expand from USD 127.20 billion in 2024 to USD 172.61 billion by 2034, growing at a CAGR of 3.1% from 2025 to 2034. Key growth drivers include government funding, digital therapeutics adoption, and rising prevalence of anxiety and depression disorders. North America leads the global market, while Asia-Pacific emerges as the fastest-growing region due to healthcare reforms and telehealth adoption.

This report is readily available for immediate delivery. We can review it with you in a meeting to ensure data reliability and quality for decision-making.

Try Before You Buy – Get the Sample Report@ https://www.statifacts.com/stats/databook-download/7328

Behavioral Health Market Highlights

- North America dominated the market in 2024, holding the largest market share.

- Asia-Pacific is projected to experience the highest annual growth rate (AGR) in the market from 2025 to 2034.

- The outpatient counseling segment led the U.S. behavioral health market by service in 2024 and is expected to maintain this dominant trend throughout the forecast period.

- The Anxiety & Depression Disorder segment held the largest market share by disorder in the U.S. behavioral health market in 2024.

- The clinic end-user segment accounted for the largest market share in 2024 and is expected to grow at the fastest rate during the forecast period in the U.S. behavioral health market.

What is Behavioral Health?

The behavioral health market refers to the production, distribution, and use of behavioral health, which includes the emotions and behaviors that affect our overall well-being. Behavioral health refers to the topics of mental distress, mental health conditions, suicidal thoughts & behavior, and substance use. Behavioral health is a broad term encompassing a wide range of fields that examine interpersonal relationships, patterns of behavior, substance use, lifestyle, and other related aspects.

Behavioral health plays an important role in overall well-being, influencing everything from physical health to relationships and daily life. How we handle challenges, stress, and emotions may affect our choices and habits. Behavioral health treatment can improve communication skills and conflict-resolution abilities.

- In September 2025, the Center of Excellence in Behavioral Health Nursing was launched by MUSC. Cathy Durhum, DNP, APRN, who is deeply invested in behavioral health, inspired the creation of this center. Source: MUSC Edu.

Artificial intelligence (AI) based behavioral health applications provide accessible and convenient support to individuals, mainly those who may have limited access to traditional therapy services, offering on-demand assistance and interventions, and further reducing barriers to seeking help. In addition, AI-based brain-computer interfaces and neurofeedback systems offer new ways of regulating emotional states and brain activity. AI improves early intervention, personalizes treatment plans, and enhances overall well-being. AI is used to streamline administrative tasks, make workflow more effective, and aid in clinical decision-making.

“Asia-Pacific’s behavioral health market is set to outpace global growth, driven by national mental health reforms and rapid adoption of telebehavioral platforms,” said [Rohan Patil], Principal Consultant at Statifacts. “At the same time, sustained U.S. investments in behavioral health workforce development are ensuring North America remains the largest regional market.”

Major Government Initiatives for Behavioral Health

- China – National Plan to Improve Mental Health Services (2025–2027): China’s National Health Commission is implementing a plan to increase access to mental health services, especially for children and adolescents, including mandating that every prefecture and city have at least one hospital offering outpatient services for mental and sleep disorders by 2025; they’ll also set up regional mental health centres and hotlines.

- WHO’s “Special Initiative for Mental Health”: The World Health Organization is running this initiative across nine countries (e.g., Argentina, Bangladesh, Ghana, Nepal, etc.) to close treatment gaps for mental health, neurological, and substance use conditions. It aims to scale up services at primary and secondary levels, especially post-COVID-19, to achieve universal health coverage for mental health.

- WHO Guidance for Mental Health Policy Transformation (2025): New guidance published by WHO urges governments to reform mental health policies aligned with human rights norms, address social determinants (like housing, employment), and build resilient, inclusive mental health systems with a focus on person-centred care and lived-experience input.

- India – Strengthening Mental Health Under Ayushman Bharat & Education Programs: In India, the central government has upgraded many Sub Health Centres / Primary Health Centres into “Ayushman Arogya Mandirs” offering integrated primary care, including mental health, trained thousands via digital modules in mental health, and introduced undergraduate clinical psychology (B.Sc. Clinical Psychology) programmes.

-

United States – Expansion of Behavioral Health Access via Federal Funding and Policy Changes: Under the Biden-Harris administration, several measures have been taken: new funding (e.g. ~$36.9 million) for behavioral health services; guidance to states to expand provider eligibility under Medicaid; investments in behavioral health workforce; expansion of crisis lifeline services; and policies to integrate behavioral health into primary care and school settings.

Key Behavioral Health Market Trends

- Expansion of Telebehavioral Health: Virtual therapy and psychiatry services are becoming mainstream due to increased patient acceptance and improved telehealth infrastructure.

- Integration with Primary Care: Behavioral health services are increasingly embedded into primary care settings for coordinated, whole-person care.

- Rise of Digital Therapeutics and Mental Health Apps: Technology-driven tools, including AI-based apps and self-guided therapy platforms, are transforming mental health delivery.

- Increased Focus on Youth Mental Health: Growing mental health challenges among children and adolescents are prompting investments in school-based and digital solutions.

-

Shift Toward Value-Based Care: Reimbursement models are evolving to reward outcomes and quality in behavioral health, encouraging data-driven, preventive care strategies.

Customize This Study as Per Your Requirement@ https://www.statifacts.com/stats/customization/7328

Market Dynamics

Drivers

-

Rising healthcare expenditure on behavioral health

The majority of the studies constantly found that interventions for mental health prevention and promotion were cost-effective or cost-saving. Healthcare expenses include the cost of treatments, procedures, equipment, and medications. According to the report published in January 2024 by the Behavioral Health Tech Conference, spending on behavioral health services among Americans with private insurance experienced a significant 53% increase from 2020 to 2022. Source: Behavioral Health Tech

-

Rising mental health disorders:

Rising mental health issues have specific factors, including a history of mental illness in a blood relative, like a parent or sibling. Stressful life situations, like financial problems, a loved one’s death, or divorce. Many research studies highlight the connection between nutrition and mental health conditions like ADHD, depression, and anxiety. The most common occurring mental health problems are mixed anxiety & depression, generalized anxiety disorder (GAD), depression, post-traumatic stress disorder (PTSD), and phobias. Whether it's meditation, journaling, walking, or something else, make a daily habit of doing something proactively to manage stress. Exercise is the best way to take care of our mental health.

Restraint

-

Limited access to behavioral health services:

Limited access to behavioral health services’ obstacles can include the cost of treatment, geographical limitations, and stigma. Mental health includes our psychological, emotional, and social well-being. It allows us to work & learn, pursue our goals, maintain relationships, and manage daily stressors. Challenges in integrating mental healthcare into primary healthcare within LMICs include a high level of stigma, high rates of comorbidity with physical health problems, poverty & social deprivation, limited community awareness of mental health, shortages of human resources, and limited infrastructure.

Opportunity

-

Integration of digital care services:

Digital healthcare offers a huge range of possibilities and may enhance the quality of patient care. The digital paradigm of history, examination, differential diagnosis, and treatment may be enhanced by tools like telehealth, wearables, sensors, mobile applications, and machine learning. Some health digitalization benefits include improved patient health outcomes through personalized treatment plans, decreased healthcare costs for both patients and providers, and expanded access to healthcare to historically marginalized communities. Digital innovation in healthcare transforms healthcare delivery, lowers costs, and increases access to care.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/7328

Behavioral Health Market Scope

| Report Attribute | Key Statistics | |

| Market Size in 2024 | USD 127.20 Billion | |

| Market Size in 2025 | USD 131.14 Billion | |

| Market Size in 2028 | USD 143.72 Billion | |

| Market Size in 2032 | USD 162.29 Billion | |

| Market Size by 2034 | USD 172.61 Billion | |

| CAGR 2025-2034 | 3.1 | % |

| Leading Region in 2024 | North America | |

| Fastest Growing Region | Asia-Pacific | |

| Base Year | 2024 | |

| Forecast Period | 2025 to 2034 | |

| Segments Covered | By Service Type, By Disorder Type, and By Region | |

| Regional analysis | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa | |

| Leading Players | Elevance Health, LLC, Oracle Corporation, Civitas Solutions Inc, Ascension, Core Solutions Inc, Pyramid Healthcare, Inc, Services Inc, Acadia Healthcare Co, Universal Health Services, Inc, Centene Corporation PLC, Welligent Inc, and Others. | |

All market estimates are based on Statifacts’ proprietary forecasting model, using 2024 as the base year. Figures are expressed in USD at constant 2025 prices.

Kindly use the following link to access our scheduled meeting@ https://www.statifacts.com/schedule-meeting

Behavioral Health Market Segmentation

Service Type Insights

Which Service Type Segment Holds the Largest Behavioral Health Market Share in 2024?

The outpatient counselling segment held the largest share of the market in 2024. Outpatient therapy allows participants to maintain their daily routines, providing a sense of normalcy during treatment. This continuity can be especially beneficial for those who find comfort in their everyday activities and social connections. As compared to hospitalization coverage, outpatient benefits cover day-to-day medical expenses like doctor consultations, prescription medications, mental health counselling, physiotherapy, and diagnostic tests.

The inpatient hospital management segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Inpatient care refers to medical treatment that requires hospitalization, which may be due to the seriousness of the patient’s condition or the complexity of the required procedures. Inpatient care needs to stay in a hospital, and outpatient care does not. One significant benefit of inpatient treatment is the variety of care it offers. It combines many forms of therapy, like family, individual, and group, and also medical and mental health support. Inpatient programs are generally designed for those experiencing severe symptoms or a high risk of harm.

Disorder Type Insights

Which Disorder Type Segment Dominated the Behavioral Health Market in 2024?

The anxiety disorder segment dominated the market in 2024. Anxiety is a normal stress reaction. Mild levels of anxiety can be beneficial in some situations. Anxiety disorders are a group of mental health conditions that cause fear, dread, and other symptoms that are out of proportion to the situation. Anxiety can create stress, but there is also a silver lining to feeling a little bit nervous. Anxiety actually releases dopamine, which motivates us to pursue rewards and take action to bring about the future we want. The two main treatments for anxiety disorders are medications and psychotherapy.

The substance abuse disorder segment is projected to experience the highest growth rate in the market between 2025 and 2034. The substance abuse disorder includes creating healthy boundaries, gaining healthy habits, coping skills, rebuilding relationships, uncovering underlying co-occurring disorders, learn about substance abuse as a disease, and breaking the cycle of addiction. Providing well-funded drug and alcohol services is good value for money because it improves health, cuts crime, and can support individuals and families on the road to recovery.

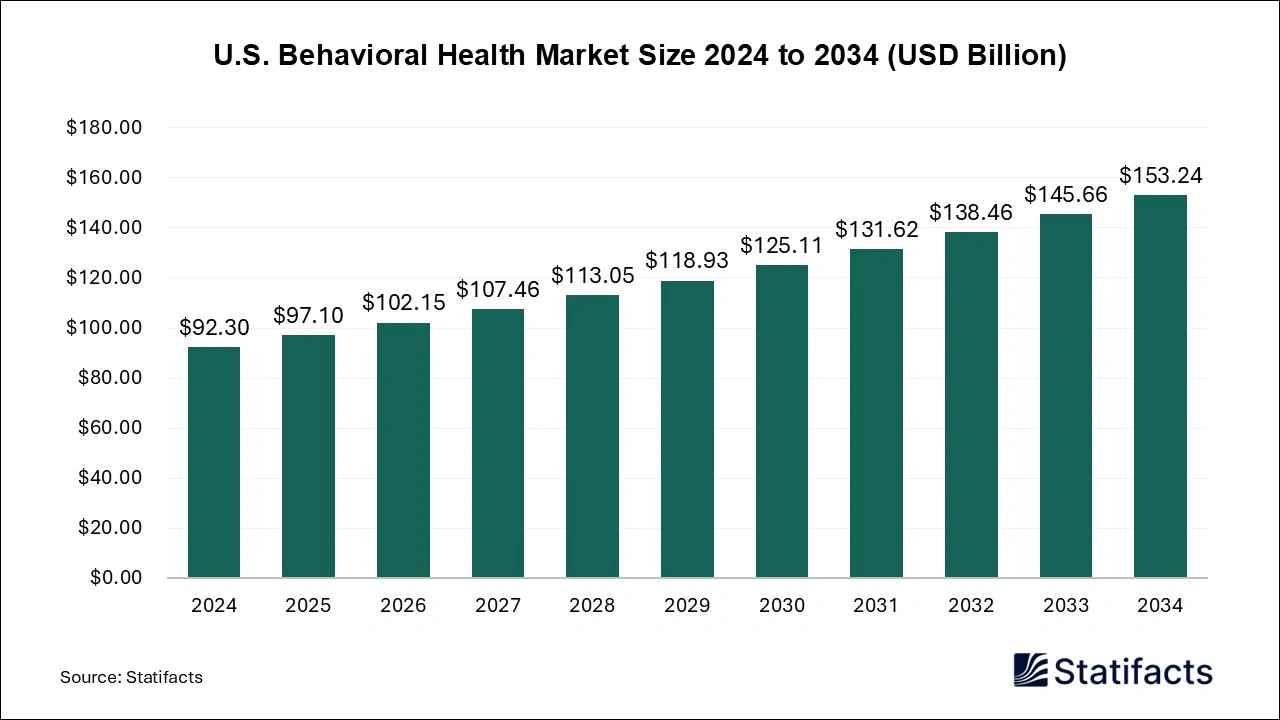

U.S. Behavioral Health Market Size 2025 to 2034 (USD Billion)

The U.S. behavioral health market was valued at USD 92.30 billion in 2024 and is projected to surpass USD 153.24 billion by 2034, growing at a CAGR of 5.2% from 2025 to 2034. Market growth is driven by rising awareness of mental health issues, increased healthcare spending, and expanding access to behavioral health services and digital therapy solutions.

North America Behavioral Health Market

North America dominated the global market in 2024 due to the rising demand for mental health services amid provider charges, investments in technology, integration of digital care services & software, and increasing awareness of mental health in the region. Mental health is common in the U.S. and around the world. The expanded access of telehealth and mobile health apps is fostering this growth. With the strong focus on advancements in AI and machine learning for personalized care, the market is surging for growth. The rapid anticipation of a resurgence in Mergers & Acquisitions (M&A), especially for mental health technology with AI leverage for accessible personalized care, further contributes to the market growth.

The U.S. dominates the regional market due to its advanced healthcare infrastructure, high prevalence of mental health and substance use disorders, and substantial public and private investment in behavioral health services. Government initiatives like the Mental Health Parity Act and the expansion of Medicaid have significantly increased access, while the rapid growth of telebehavioral health and digital therapeutics has enhanced service delivery. Additionally, the U.S. leads in workforce development, research, and innovation, with a large number of behavioral health professionals and tech-driven startups.

It is estimated that more than one in five US adults lives with a mental illness. According to a report published by the National Alliance on Mental Illness (NAMI), 22.8% of U.S. adults experienced mental illness in 2021. Source: NAMI Org.

Asia Pacific Behavioral Health Market

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period because of government support for mental health services, increased insurance services, adoption of digital & telehealth platforms for accessible and convenient care, and growing prevalence of mental health disorders in the Asia Pacific region. Asia has experienced significant growth in acceptance of mental health care, driven by rising awareness and government initiatives in promoting awareness as well as specialized care. The growing availability of specialized mental health apps is adding to this growth. Singapore is a leading player in the development of mental health apps across Asia.

China is a major player in the regional market due to its large population base, increasing prevalence of mental health disorders, and strong government commitment to expanding mental health services. In recent years, China has implemented national policies and multi-year plans to improve mental health infrastructure, including the expansion of psychiatric hospitals, integration of mental health into primary care, and establishment of national mental health hotlines. Significant investments in digital health and AI-driven platforms have also boosted access, especially in rural areas. With growing public awareness, reduced stigma, and a robust public health strategy, China is emerging as the key driver of behavioral health market growth across the Asia-Pacific region.

According to a report, in China, about 170 million people likely suffer from mental disorders. Hong Kong has more than 2 million people likely suffering from mental health disorders, which is 18% of the population. Source: RGARE

Browse More Research Reports:

- The global behavioral analytics market size is calculated at USD 1,158 million in 2024 and is predicted to reach around USD 13,250 million by 2034, expanding at a CAGR of 27.6% from 2024 to 2034.

- The U.S. health coach market size is calculated at USD 4,910 million in 2024 and is predicted to attain around USD 9,570 million by 2034, expanding at a CAGR of 6.9% from 2025 to 2034.

- The U.S. population health management market size accounted for USD 12,080 million in 2024 and is expected to exceed around USD 62,960 million by 2034, growing at a CAGR of 17.95% from 2025 to 2034.

- The U.S. digital health market size was estimated at USD 79.12 billion in 2024 and is projected to be worth around USD 239.23 billion by 2034, growing at a CAGR of 11.7% from 2025 to 2034.

- The global animal intestinal health market size is worth around USD 1,620 million in 2024 and is anticipated to reach around USD 2,307 million by 2034, growing at a CAGR of 3.6% from 2024 to 2034.

Ready to Dive Deeper? Visit Here to Buy Databook & In-depth Report Now@ https://www.statifacts.com/order-databook/7328

Behavioral Health Market Top Companies

- Elevance Health, LLC - Elevance Health offers integrated behavioral health services through its affiliated health plans, focusing on whole-person care and access to mental health professionals.

- Oracle Corporation - Oracle supports behavioral health organizations with robust cloud-based health IT solutions, enabling efficient patient data management and improved clinical decision-making.

- Civitas Solutions Inc - Civitas Solutions provides community-based behavioral health services for individuals with intellectual and developmental disabilities, emphasizing personalized, home- and community-based care.

- Ascension - Ascension delivers compassionate behavioral health treatment through its nationwide network of hospitals and outpatient clinics, integrating mental and physical health services.

- Core Solutions Inc - Core Solutions offers electronic health record (EHR) software specifically designed for behavioral health providers, helping streamline care coordination and compliance.

- Pyramid Healthcare, Inc - Pyramid Healthcare delivers a full continuum of behavioral health services, including substance use treatment and mental health programs for adults and adolescents.

- Services Inc - Services Inc provides community-based mental health support, offering individualized treatment plans and recovery-focused care.

- Acadia Healthcare Co - Acadia Healthcare operates a wide range of inpatient and outpatient behavioral health facilities across the U.S., offering specialized care for addiction, trauma, and psychiatric conditions.

- Universal Health Services, Inc - Universal Health Services manages one of the largest networks of behavioral health facilities, offering both acute inpatient services and outpatient treatment for mental health and substance use disorders.

- Centene Corporation PLC - Centene offers behavioral health benefits through its managed care plans, providing access to mental health professionals and support for individuals with complex needs.

-

Welligent Inc - Welligent provides cloud-based EHR solutions tailored for behavioral health and human services providers, supporting efficient documentation, billing, and outcomes tracking.

Recent Developments

- In September 2025, a new youth-focused behavioral health provider dubbed Velocity was launched by Embark Behavioral Health vet Chris Perkins. A new behavioral health provider aims to address two of the industry’s biggest limitations, such as the need for a skilled, sustainable workforce and the rising cost of pediatric inpatient care. Source: Behavioral Health Business

- In July 2025, a new training manual to equip health and social care professionals and other workers to deliver effective and safe support to adults with mental health and psychological needs was published by WHO in collaboration with UNICEF. The manual provides a competency, structure-based approach assessing and teaching foundational helping skills like active listening, empathy, and partnership among specialist and non-specialist workers. Source: World Health Organization (WHO)

Case Study: Velocity — A Youth-Focused Behavioral Health Provider

Overview:

In September 2025, Velocity was launched by Chris Perkins, a veteran from Embark Behavioral Health. The company aims to address two of the industry’s biggest challenges: the shortage of a skilled behavioral health workforce and the rising costs of pediatric inpatient care.

What Happened:

Velocity is designed as a youth-centered behavioral health provider that focuses on accessible, affordable, and sustainable care models for children and adolescents. By integrating evidence-based therapies with innovative workforce strategies, it hopes to reduce the burden on families while ensuring long-term care quality.

Why it Matters to the Behavioral Health Market:

- This case demonstrates how targeted innovation is reshaping behavioral health services in line with the trends highlighted in your press release:

- Youth Mental Health Focus: Velocity addresses the urgent need for specialized solutions in adolescent care.

- Workforce Sustainability: Tackling staffing shortages head-on, which is one of the industry’s most pressing challenges.

- Cost Reduction: Developing models that aim to make pediatric inpatient care more affordable and scalable.

Key Takeaway:

The launch of Velocity showcases how new entrants are directly responding to systemic gaps in the behavioral health market. For your press release, weaving in this case study can strengthen engagement by showing stakeholders that the market’s growth isn’t just about rising demand it’s about innovative solutions tackling access, affordability, and workforce shortages.

Segments Covered in the Report

By Service Type

- Outpatient Counselling

- Intensive Care Management

- Home-based Treatment Services

- Inpatient Hospitals Management

- Emergency Mental Health Service

- Others

By Disorder Type

- Anxiety Disorder

- ADHD

- Bipolar Disorder

- Depression

- Eating Disorder

- Post-Traumatic Stress Disorder (PTSD)

- Substance Abuse Disorder

- Psychosis

- Schizoaffective Disorder

- Schizophrenia

- Dual Diagnosis

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

You can place an order or ask any questions, please feel free to contact us at sales@statifacts.com

Statifacts offers subscription services for data and analytics insights. This page provides options to explore and purchase a subscription tailored to your needs, granting access to valuable statistical resources and tools. Access here - https://www.statifacts.com/get-a-subscription

Contact US

- Ballindamm 22, 20095 Hamburg, Germany

- Web: https://www.statifacts.com/

-

Europe: +44 7383 092 044

About US

Statifacts is a leading provider of comprehensive market research and analytics services, offering over 1,000,000 market and custoer data sets across various industries. Their platform enables businesses to make informed strategic decisions by providing full access to statistics, downloadable in formats such as XLS, PDF, and PNG.

Our Trusted Data Partners:

Precedence Research | Towards Healthcare | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Nova One Advisor

Explore More Reports:

- Vitamin D Market - https://www.statifacts.com/outlook/vitamin-d-market

- Bamboo Flooring Market - https://www.statifacts.com/outlook/bamboo-flooring-market

- Spine Biologics Market - https://www.statifacts.com/outlook/spine-biologics-market

- Membrane Oxygenator Market - https://www.statifacts.com/outlook/membrane-oxygenator-market

- Hydrazine Hydrate Market - https://www.statifacts.com/outlook/hydrazine-hydrate-market

- Chelants Market - https://www.statifacts.com/outlook/chelants-market

- Cricket Equipment Market - https://www.statifacts.com/outlook/cricket-equipment-market

- Wafer-Level Vacuum Laminator Market - https://www.statifacts.com/outlook/wafer-level-vacuum-laminator-market

- Quantum Encryption Communication Modules Market - https://www.statifacts.com/outlook/quantum-encryption-communication-modules-market

- Automotive Copper Core Cable Market - https://www.statifacts.com/outlook/automotive-copper-core-cable-market

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.